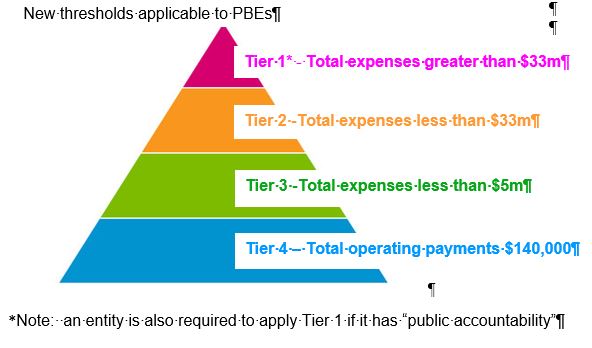

Updated PBE Tier Sizes – Reporting relief to benefit smaller charities and NFP

The XRB has amended XRB A1 Application of the Accounting Standards Framework to increase the Public Benefit Entities (public sector and not-for-profit entities) size thresholds for Tiers 1, 2 and 3 as follows:

- Tier 1/2: $33 million total expenses (from $30 million)

- Tier 3: $5 million total expenses (from $2 million)

The effective date of accounting periods that end on or after 28 March 2024 means that entities with a balance date of 31 March 2024 can apply the new tier sizes immediately. As a result, some entities may be eligible to move from Tier 2 to Tier 3 and therefore able to benefit from a notable reduction in reporting requirements.

Disclaimer

Unfortunately, with details changing all the time and at such speed, we need to add that the above content is correct at the time of writing as far as the author is aware and is very much subject to change. We have, to the best of our ability, acknowledged any shared content. All related links provided to the corresponding websites are subject to change as they are live links.

Source: XRB (External Reporting Board) Updated PBE Tier Sizes » XRB